We are still talking about trade battles with China and an arguably inverted yield curve. Yes, there are other perennial thorns in the paw (Iran and North Korea) but they don’t have much market moving history. As June ended, we got a trade battle truce and the stock market soared. Imagine what will happen if something actually gets done! I still have a problem with calling the yield curve inverted, as most of it is upward sloping. Only the three-month bill is out of whack as I write this on July 1 and that is rather tied to the Fed. Will they cut, or won’t they? Before the trade truce, fed funds trading had a rate cut for a certainty for this month. Now? Maybe not so certain. What I can see that is problematic is that the entire curve shifted lower compared to a month ago. And a quick scan of some global debt shows a lot of fractional, and even negative, benchmark yields. All that cannot be good. Yet gold is backing down to test its breakout. Again, I am writing

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

What's Inside...

President’s Letter - Reflections on the Association Year 2018-2019

by Scott G. Richter, CMT, CFA, CHPLooking back on the last 12 months, I think we’ve logged a solid performance at the TAN Association. A few highlights that come to mind: Opening our India Office under Joel...

Why Aren’t You Writing?

by Michael Kahn, CMTWhen anyone asks me what they can do to get ahead in their chosen field, I have but one word for them – write. It does not matter what field you are in; technical analysis or auto detailing. And it...

Copyright Basics, Part 4

by Joyce L. Miller & Dr. C. Daniel MillerThis is part 4 of a four-part series. Creative Commons In our previous three articles on copyright basics, we mentioned four categories that allow us to evaluate the need for copyright clearance. We...

Atlanta Chapter Speaker Review

by Paul WankmuellerWhat a turnout! About 40 members and guests filled the room at the University of Georgia Terry College of Business to hear a presentation featuring former TAN Association president Craig...

Member Interview with Les Williams

by Les Williams, CMTPlease tell us what you do professionally. I am a portfolio manager and technical analyst. How did you get there? It all started with a course in statistics where moving averages were applied to...

Denver Chapter Speaker Review

by Jason Meshnick, CMTThe Denver Chapter was very excited to host Will Geisdorf, CMT of Ned Davis Research at our June meeting. Will’s presentation, entitled “Wall of Worry,” gave a thorough update of NDR’s...

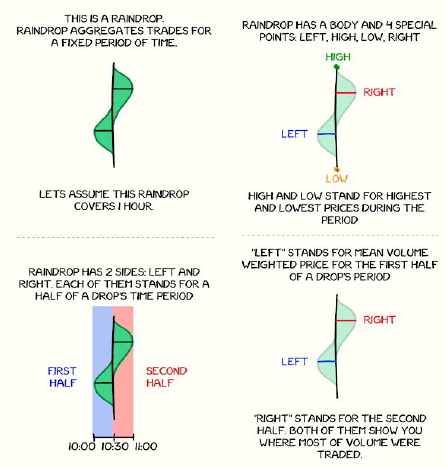

Raindrop Charts ™ - Summary White Paper

by Ruslan LagutinPlease see the complete white paper here Compare Raindrops to other chart types here. — There are many different styles of charts used by financial analysts to illustrate changes in price...

Minnesota Chapter Meeting Review

by Mahesh Johari, CFAJim Paulsen presented to the Minnesota Chapter on June 18, 2019. Jim is Chief Investment Strategist for the Leuthold Group and formerly held the same title at Wells Fargo. He...

Membership News

by Marie PenzaThe TAN Association would like to congratulate the following members on their new positions: Kevin Heffernan, CMT, Managing Director – Head of Sales & Trading at Beacon Securities...

Looking back on the last 12 months, I think we’ve logged a solid performance at the TAN Association.

A few highlights that come to mind:

- Opening our India Office under Joel Pannikot

- Hosting a successful Symposium in New York

- Organizing our Committee Governance Framework

- Launching the Digital Badging verification system

- Relaunching “Technically Speaking” under Michael Kahn, CMT

- Focusing Board activities with our Strategic Direction

I want to thank our staff, committee volunteers, chapter heads, speakers, members, and Board for putting in the time to grow our organization and “Raise the Bar.”

Next year looks equally busy and challenging. We will continue to expand globally, hold mini-Symposium activities outside the U.S., and develop our content delivery platform for members. Remember, it is our goal to Motivate, Inspire, Connect, and Educate members!

That said – look for a way to get involved and contribute to our growth:

- Join in Chapter activities

- Sponsor a CMT Candidate

- Plan to attend a Symposium next year

- Consider presenting a

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Scott G. Richter, CMT, CFA, CHP

Scott Richter, CMT, CFA, CHP is a senior portfolio manager for Westfield, which manages over $4B in AUM. He is the lead portfolio manager for alternative assets and is also responsible for investments in the energy and utility sectors. He was formerly the co-manager...

When anyone asks me what they can do to get ahead in their chosen field, I have but one word for them – write. It does not matter what field you are in; technical analysis or auto detailing. And it does not matter if you have a doctorate degree or are a newbie right out of high school.

True, the more experience you have and, arguably, the more schooling you have, the more likely you can put a few ideas on paper (yes, old school) that will have value for someone else. But everyone has something to say. Everyone.

At first, you probably will have an audience comprised of your mother and spouse. Keep going!

The idea is to hone your writing and professional skills while you build up a body of work. Do you think that an employer might be impressed with the blog you’ve been writing for the past year? Or

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Michael Kahn, CMT

Michael Kahn, who holds a Chartered Market Technician (CMT) designation, is a seasoned financial services strategist, analyst, columnist, educator and speaker. Michael has been working with charts and technical analysis since 1986. He is the author of three books on...

This is part 4 of a four-part series.

Creative Commons

In our previous three articles on copyright basics, we mentioned four categories that allow us to evaluate the need for copyright clearance. We covered in detail three of those categories: fair use, public domain, and works belonging to a third party requiring permission. In this article we will discuss the fourth category, Creative Commons (CC).

Creative Commons provides free, easy-to-use copyright licenses to make a simple and standardized way to give the public permission to share and use your creative work on conditions of your choice.

There is a common misconception that works dedicated through a Creative Commons license are either fair use or public domain works. They fall into neither category. Many incorrectly assume that any CC symbol attached to a work means that it may be used in any manner that suits their purpose. Such uses can have legal repercussions.

The Nature

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Joyce L. Miller

Joyce L. Miller is The Copyright Detective®. She is a freelance copyright specialist and copyright compliance consultant to content providers, writers, authors, independent publishers, and publishing support teams. She is an award-winning author and an educator...

Dr. C. Daniel Miller

Dr. C. Daniel Miller is a freelance consultant on the business of independent publishing, copyright clearance and compliance, management of copyright permissions acquisition projects, project management of independent publishing, marketing and distribution of publications, and...

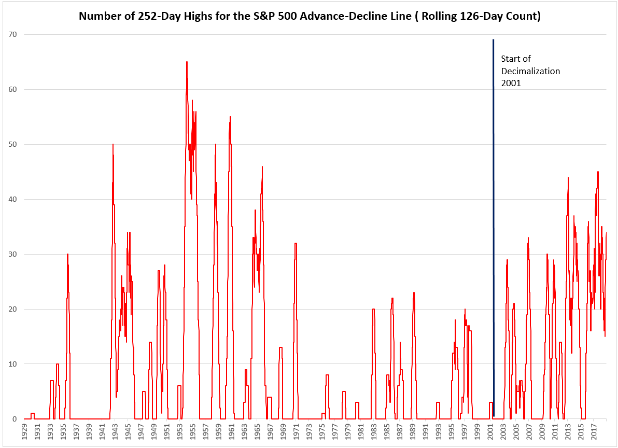

What a turnout! About 40 members and guests filled the room at the University of Georgia Terry College of Business to hear a presentation featuring former TAN Association president Craig Johnson, CMT, CFA. Some key insights from the meeting include how the Advance/Decline line is different depending on the year at which you are looking. Decimalization changed the structure, as it is easier to advance or decline based on 1 tick, vs an eighth prior. Craig pointed out that he prefers to use a 26-week new high vs a 52-week high. He also explained how the third year in a Presidential election usually plays out, and that Microsoft might be included as a staple in the near future instead of being grouped in technology.

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Paul Wankmueller

Paul Wankmueller, who holds the Chartered Market Technician (CMT) designation, is a Market Analyst at ICE. He began his career in commodities by working as a research analyst for Michel Marks and 816 Partners immediately after graduating from Monmouth University. With Michel’s...

Please tell us what you do professionally.

I am a portfolio manager and technical analyst.

How did you get there?

It all started with a course in statistics where moving averages were applied to inventory control. The charts shown reminded me of stock charts and I applied moving averages to them. Then I took a course in entrepreneurship where our challenge was to brainstorm a product or service, incorporate a company and run with it. My group incorporated and registered with the State of Texas as a money management firm. I’m not sure if my degrees in accounting and psychology helped but they didn’t hurt.

In the early 70s, I was a partner in an accounting firm when IRAs were introduced. We encouraged clients to open IRA accounts and saw the opportunity to establish an RIA firm in addition to a property management company.

Who was an early mentor in your career?

I did not have

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Les Williams, CMT

Biography coming

The Denver Chapter was very excited to host Will Geisdorf, CMT of Ned Davis Research at our June meeting. Will’s presentation, entitled “Wall of Worry,” gave a thorough update of NDR’s macro positioning. At a high level, Will says that the U.S. economy is unlikely to enter a recession in the near term, so any market weakness is expected to be limited. However, the trade war limits the prospect for global economic recovery.

The team at NDR has a great perspective on the markets, best encapsulated by Ned Davis’ saying that “if you can’t quantify it, don’t pay attention to it.” As a result, NDR doesn’t use Fed policy as a variable in its models. However, the impacts of Fed policy are key drivers of many of their models.

One relatively unique dataset that Will shared was the breadth of manufacturing Purchasing Managers’ Indexes (PMI). Each PMI is a survey that measures

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Jason Meshnick, CMT

Jason Meshnick, CMT, is the Director of Product Management at Markit Digital, a division of IHS Markit. There, he creates well-known market analytics including the CNN Business Fear & Greed Index. His past career included work as a principal trader, market maker, and hedger....

Please see the complete white paper here

Compare Raindrops to other chart types here.

—

There are many different styles of charts used by financial analysts to illustrate changes in price action over a period of time. However, most of them do not contemplate trading volume with any level of granularity. We propose a novel solution to this problem – new type of chart, one that combines volume and price data into a single visualization while also filtering out some of the noise like arbitrary open and close prices. We call this new type of chart the Raindrop Chart

Abstract

The Raindrop Charts ignore artificial breakpoints, such as open and close prices, to instead illustrate price and volume movement instead of just the price change.

Each bar, known as

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Ruslan Lagutin

Ruslan Lagutin is the CTO and co-founder of TrendSpider and has spent his entire career working in the charting and technical analysis industry, with time spent at both eSignal and TradingView. TrendSpider is a Chicago-based startup focused on building software that improves...

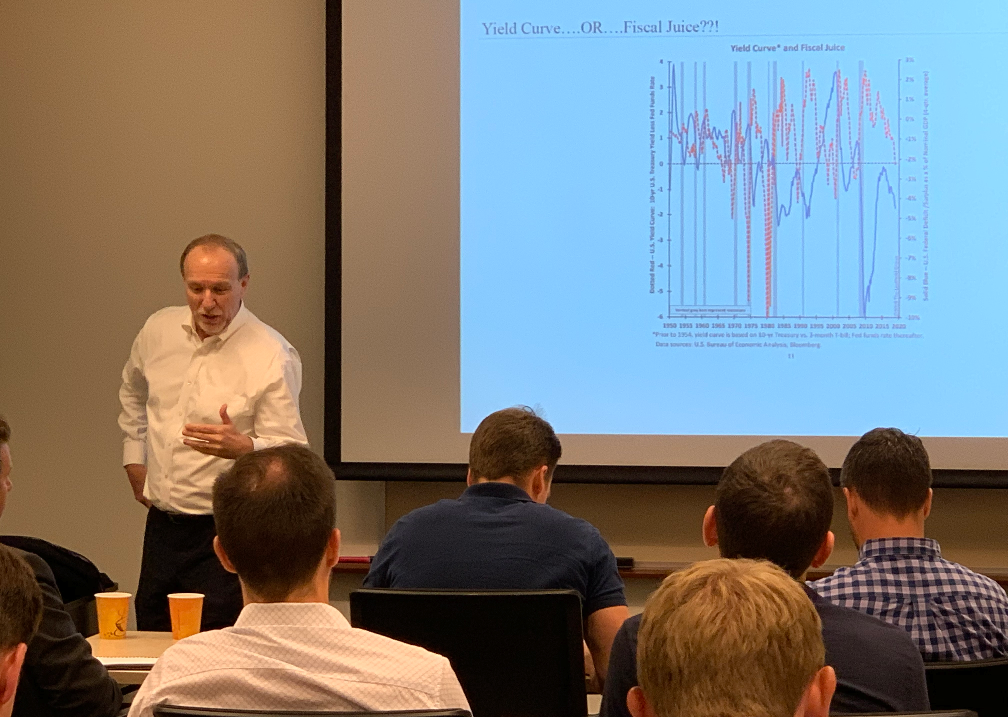

Minnesota Chapter Meeting Review

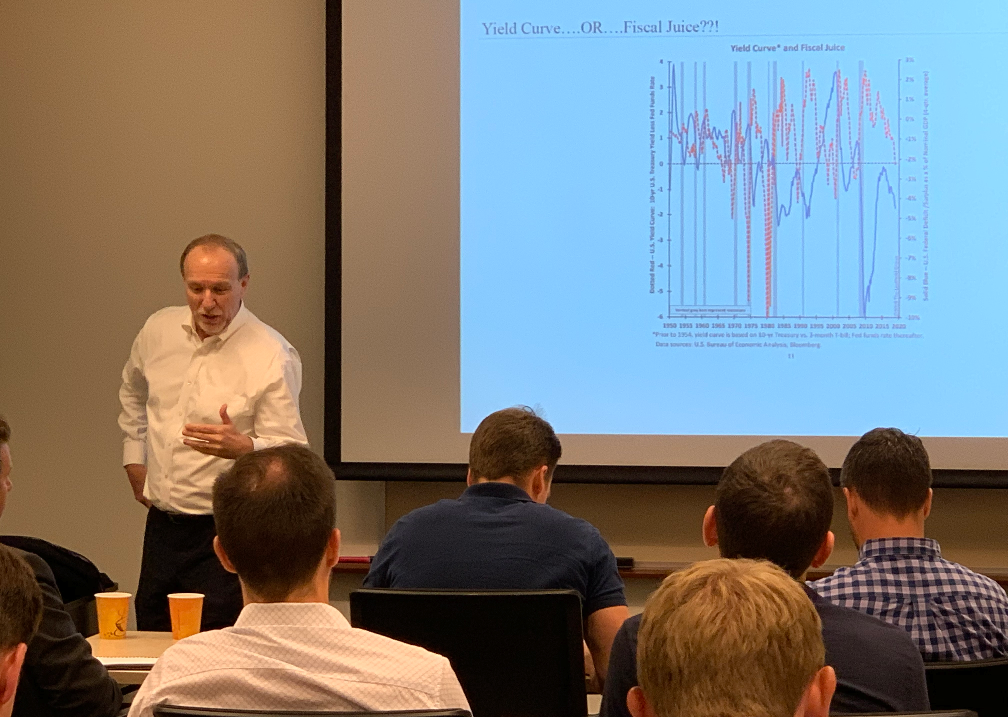

Jim Paulsen presented to the Minnesota Chapter on June 18, 2019. Jim is Chief Investment Strategist for the Leuthold Group and formerly held the same title at Wells Fargo. He presented a broad market view covering fiscal and monetary policy, interest rates, and equity indexes.

His main theme was the “3-Gun Gooser,” a trifecta of fiscal, monetary, and credit stimulus which presents today as high deficits, a Federal Reserve tilting toward lowering rates, and low long-term Treasury rates.

The stimulative environment comes during a moderately valued equity market, with trailing S&P 500 P/E multiples in the 52nd percentile and forward P/E in the 67th percentile historically. Although Paulsen said he was nervous about the 10-year-old recovery, the inverted yield curve, and overstaying in the friendly equity environment, his tone and body language were very bullish.

Paulsen viewed the recent slowdown in earnings and the economy as a lagged response to 2018’s monetary tightening.

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Mahesh Johari, CFA

Mahesh Johari is an independent investor based in the Minneapolis area. He holds degress in mathematics and economics from the University of Illinois and the University of

The TAN Association would like to congratulate the following members on their new positions:

- Kevin Heffernan, CMT, Managing Director – Head of Sales & Trading at Beacon Securities Limited

- Tim Mazanec, CFP, CRPC, CMT, Wealth Management Advisor at The Harvest Group, Wealth Management, LLC

- Muhammad Hafiz Bin Muhammad Yazid, Market Risk Summer Analyst at Crédit Industriel et Commercial (CIC)

- Gina Martin Abrams, CFA, CMT, Head of Equity Strategy, ETF and ESG Research at Bloomberg LP

- Tyler Yell, CMT, Toyota North America Graduate Management Associate at Toyota North America

Updating Your Profile

Please be sure your profile is current by logging in to the website and updating your profile so we can better communicate with you!

CMT Registration

Registration is open for the December 2019 test administration; Level I & II exams will be from December 6 to the 15, Level III is on December 12. Early registration is open until August 26. Candidates have the option of registering as

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Marie Penza

Marie Penza serves as the Director of Member Services for the CMT

New Educational Content This Month

-

August 26, 2020

The CMT Experience

Presenter(s): Tyler Wood, Dave Lundgren, CMT, CFA

-

August 26, 2020

Reading the Current Market in Light of History’s Lessons

Presenter(s): Ryan Detrick, CMT

-

August 12, 2020

How to Spot Major Trend Reversals with Elliott Waves and Socionomics: Examples from Asia’s Ongoing Secular Bull Market

Presenter(s): Mark Galasiewski