Letter from the Editor

November proved to be an interesting month for the markets. Just before the market burped up a post-Thanksgiving 2% pullback, the Russell 2000 finally broke out from its 2019 range. False hope? Recession time? Once again, the sloth (look it up) of bearish economists was out with the utterly useless prediction that a recession was coming by the end of 2021. Thanks for the heads up, fellas. Have you seen a price chart? I keep a collection of equally dim-witted headlines. Last month’s favorite was “Don’t Time the Market, but If You Do, Here’s When the Bear Might Come Knocking.” Do as I say, not as I do. Gold is still correcting, Oil showed a little stealthy increase, the dollar looks a little shaky and apparently Europe is still so bad that the ECB is dipping back in the QE well…Because it worked so well the last time. Again, have they ever seen a price chart? This month in Technically Speaking, we’ve got part three of Bruno DiGiorgi’s History of Wall Street, and George Schade, CMT, continues the history theme withTo view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

What's Inside...

The 47th Annual TAN Association Symposium 2020

by Tyler WoodWith the 47th Annual Symposium approaching, and the early registration pricing deadline looming on Wednesday the 18th, we’ve compiled a few highlights from previous interviews with longtime members...

President's Letter

by Scott G. Richter, CMT, CFA, CHPCMT Indian Summit – Success! I would like to congratulate our Indian Office for a successful 2019 Summit! There were so many positives: Over 200 attendees Top...

Inspiration for Posterity - Preserving the Rich History of Technical Analysis

by George A. Schade, Jr., CMTRecently, longtime CMTA member Ken Tower introduced a group of us to the website http://tabellmarketletter.com. The pages contain a treasure trove of historical materials and exemplify what market...

New York Chapter Speaker Summary

by Tom Bruni, CMTOn Wednesday, November 20th the New York Chapter hosted Gina Martin Adams, CMT, Chief Equity Strategist and Director of Global Equity Strategy, ETF and ESG Research at Bloomberg Intelligence. Her...

Member Interview – Stanley Dash

by Stanley Dash, CMTPlease tell us what you do professionally. I currently serve as Program Director of the TAN Program here at the TAN Association. The curriculum and the exams fall under my purview. Of...

Richmond Chapter Speaker Review

by J. Cody Tafel, CMT, CAIAKatie Stockton, CMT, founder and managing partner of Fairlead Strategies, presented to the Richmond TAN Association Chapter and the University of Richmond Technical Analysis class on November 20,...

The History of Wall Street

by Bruno DiGiorgiThis is the third installment of a rerun of a periodic series chronicling the history of the street. The series originally ran in Technically Speaking beginning in September 2000. Here is the first...

Minnesota Chapter Speaker Review

by Jamie Keelin, MBA, CMTThe Minnesota CMT Chapter’s November meeting featured Harry J. Campbell III of LayLine Asset Management, Inc. Harry started his career at Kerber Financial, continued at Dougherty &...

Members in the Media

by Perry J. KaufmanThe sixth edition of Perry Kaufman’s Trading Systems and Methods was published by Wiley in November. This book, which has been used as a definitive reference on trading systems for more than 30...

Job Posting

by Marianna TesselloFinancial Market Newsletters Writers/Analysts True Market Insiders We are a publisher of subscription-based online financial market research articles, hiring market analysis writers for our growing...

Membership News

by Marie PenzaMembers on the Move The TAN Association would like to congratulate the following members on their new positions: Robert Varghese, CMT, EVP, Portfolio Strategy & Management at Banyan Investment...

With the 47th Annual Symposium approaching, and the early registration pricing deadline looming on Wednesday the 18th, we’ve compiled a few highlights from previous interviews with longtime members featuring personal stories and testimonies about past Symposiums.

“I found the conferences especially valuable in meeting other technicians and as learning experiences,” said Richard Dickson, recounting Association benefits he most enjoyed.

Les Williams, CMT, told a story of one experience he remembered from a gathering in 1987:

“Prior to introducing each speaker, the MC would announce the current Dow reading. The first reading was down 125. I thought he meant down 1.25. I had gone 100% to cash on the Thu. before and thought I had blown it.

“Speakers came to the podium all bent out of shape. During the day, fewer and fewer attendees remained. One speaker, I’m pretty sure was Alan Shaw, came to the podium, threw his papers in the air and

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Tyler Wood

Tyler Wood is the Managing Director of Global Business Development at the TAN Association. In collaboration with TAN Association members and charterholders, Tyler has presented the tools of technical analysis around the world to investment firms, regulators, exchanges, and...

CMT Indian Summit – Success!

I would like to congratulate our Indian Office for a successful 2019 Summit!

There were so many positives:

- Over 200 attendees

- Top Technical Analysis speakers and practitioners with great content

- Formed many new partnerships with academic institutions and individual students

- We enjoyed a wonderful and supportive set of sponsors

- Experienced significant media exposure

- Summit attendees were treated to a beautiful venue in the Taj Lands End

- Keynote speakers participated in Fireside Chat video recordings for later release

- Awesome volunteers and staff made the whole thing happen

We were blessed to have all of the hard work pay off and make a wonderful statement about our presence and commitment to the Indian market. We further advanced our strategic initiative of being a strong advocate for technical analysis globally. And we accomplished our objectives of connecting, inspiring, motivating and educating our members, associates and guests.

Please be on the lookout for the content and videos from the Indian Summit

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Scott G. Richter, CMT, CFA, CHP

Scott Richter, CMT, CFA, CHP is a senior portfolio manager for Westfield, which manages over $4B in AUM. He is the lead portfolio manager for alternative assets and is also responsible for investments in the energy and utility sectors. He was formerly the co-manager...

Recently, longtime CMTA member Ken Tower introduced a group of us to the website http://tabellmarketletter.com. The pages contain a treasure trove of historical materials and exemplify what market technicians can and should do to preserve the history of our discipline.

Tabell Market Letter is an internet archive of 48 years of weekly stock market technical letters written by Edmund W. Tabell (1904-1965) and his son Anthony W. Tabell. Father and son wrote over 2,700 letters from December 2, 1944, to August 7, 1992.

The first letter was entitled Technical Market Action and stated that the opinions of price trends and occasional buy and sell recommendations would be based “simply on the writer’s interpretation of their technical market action, as shown on charts” of the market averages and securities. The Tabells adhered to this philosophy. The December 1, 1948 issue showed the name that would thereafter be used, Tabell Market Letter.

Edmund Tabell

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

George A. Schade, Jr., CMT

George A. Schade, Jr., who holds a Chartered Market Technician (CMT) designation, has written extensively about the people and innovations that have advanced the field of technical analysis within financial markets. A member of the TAN Association since 1987, he has written...

On Wednesday, November 20th the New York Chapter hosted Gina Martin Adams, CMT, Chief Equity Strategist and Director of Global Equity Strategy, ETF and ESG Research at Bloomberg Intelligence. Her presentation was entitled “Equity Market Outlook: When will the bell ring on the bull market?” and discussed what today’s evidence suggests is in store for the year ahead.

Gina holds both the CFA and TAN designations, so her process combines fundamental, technical, and quantitative analysis to form an opinion. Her weight of the evidence approach is summarized into a “market health checklist” that she’s crafted over the course of her more than two-decade-long career.

This scorecard includes fifteen factors ranging from technical metrics, such as price momentum and breadth, to fundamental factors, such as earnings momentum and relative value. Gina explained that by using this scorecard, she’s able to stay on the right side of the long-term trend.

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Tom Bruni, CMT

Tom Bruni, CMT is a Technical Analyst at All Star Charts and the founder of BruniCharting. In May 2016 Tom graduated Magna Cum Laude from Molloy College's Business Honors Program where he spent the majority of his four years exploring career paths in the fields of Accounting and...

Please tell us what you do professionally.

I currently serve as Program Director of the TAN Program here at the TAN Association. The curriculum and the exams fall under my purview. Of course, I don’t do all that in a vacuum. In addition to my colleagues on staff, three groups of members are essential to this process. The Curriculum and Test Committee has oversight responsibility for the curriculum and the exams. The subject matter experts write and review exam materials. And the exam graders pore over each Level III exam paper as part of the scoring process. Their contributions are at the heart of the credentialing program, but it also means that a significant part of what I do is coordinate their efforts.

How did you get there?

My career in markets and on Wall Street (literally, the street that runs from Broadway to the East River) seems like a blur

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Stanley Dash, CMT

Stanley Dash is the TAN Program Director at the TAN Association, a global credentialing body. In this role, Mr. Dash works with subject matter experts, candidates, and the Association's members to maintain and improve the curriculum, the test experience, and the value of the...

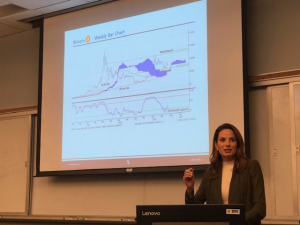

Katie Stockton, CMT, founder and managing partner of Fairlead Strategies, presented to the Richmond TAN Association Chapter and the University of Richmond Technical Analysis class on November 20, 2019.

We had a great meeting and Katie is very supportive of her alma mater, the University of Richmond, coming back each year to guest lecture to Professor Greg Sabo’s Technical Analysis class in the Robins School of Business. We are glad for this great opportunity to host chapter meetings in conjunction with the class. This gives the students insight into the current financial sector environment, and provides them with valuable networking opportunities with local finance professionals.

As always, Katie did a wonderful job of discussing her current outlook on the global financial markets, and the discussion was wide-ranging from individual stocks to currencies, commodities, fixed income, global equity indexes and even cryptocurrencies. The students gained a lot of extra

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

J. Cody Tafel, CMT, CAIA

Cody Tafel is an Investment Strategist within the Strategic Advisory Team for TSW (Thompson, Siegel & Walmsley), a multi-billion dollar Richmond, Virginia based registered investment advisor. With a focus on asset allocation, investment strategy and business...

This is the third installment of a rerun of a periodic series chronicling the history of the street. The series originally ran in Technically Speaking beginning in September 2000.

Here is the first of two Manhattan melodramas for your consideration. It’s a story of an out-of-towner who, after showing up in Manhattan, has his only form of transportation burned to the ground, is forced to live in the streets and is then sued for negligence. The second is a story of a fast-talking city slicker who sells real estate he doesn’t own to gullible foreigners. Common stories? Both take place in the 1600s!

Our first saga begins with one Adrian Block, Captain of the Dutch ship, Tigre. Captain Block set sail in 1613 to establish a fur trade for his sponsors. Not reaching New York harbor until the fall of that year, Block decided to spend the winter on the island the

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Bruno DiGiorgi

The Minnesota CMT Chapter’s November meeting featured Harry J. Campbell III of LayLine Asset Management, Inc. Harry started his career at Kerber Financial, continued at Dougherty & Company, and then formed LayLine in 2014.

The topic was intermarket analysis: how relationships between four major markets can give insights into each individual market. Harry identifies the major four markets as interest rates, foreign exchange, commodities, and equities. For interest rates, the 5-year T-Note is used as a proxy for growth and the 30-year T-Note as a proxy for inflation. The U.S. dollar, or UUP ETF ,is used as the proxy for the forex markets. A commodity proxy is provided by the DBC Invesco DB Commodity Index Tracking Fund. The equity market proxy is the S&P 500 Index.

Harry applies five major technical analysis techniques to the intermarket charts:

- Trendlines and triangles – especially those triangles converging to potential breakouts,

- Support and Resistance,

- Fibonacci Levels,

- 50- and 200-day

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Jamie Keelin, MBA, CMT

Jamie Keelin, who holds a Chartered Market Technician (CMT) designation, is the Chief Investment Strategist at Frazer Bay Investments, LLC. He has extensive financial markets and institutional equity trading experience and knowledge. While working at a mid-size investment...

The sixth edition of Perry Kaufman’s Trading Systems and Methods was published by Wiley in November. This book, which has been used as a definitive reference on trading systems for more than 30 years, garnered significant praise upon its latest release. Portions of Kaufman’s work are included in the TAN Program curriculum and may appear on the exams.

Trading Systems and Methods, Sixth Edition is “[p]robably the most comprehensive guide to trading systems ever written from one of the foremost experts in the field,” according to Jack Schwager. “This is an invaluable reference work for anyone with an interest in trading systems.” Other editorial reviews offered similar praise.

“This is a remarkably insightful book about the ins and outs of the futures market. In his usual inimitable style, Perry does a wonderful job of showing the beginner and the experienced person what it takes to build and use a successful trading system,”

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Perry J. Kaufman

Perry J. Kaufman writes extensively on markets and strategies. He began his career as a “rocket scientist,” first working on the Orbiting Astronomical Observatory (OAO-1), the predecessor of the Hubble Observatory, and then on the navigation for Gemini, later used for Apollo...

Financial Market Newsletters Writers/Analysts

True Market Insiders

We are a publisher of subscription-based online financial market research articles, hiring market analysis writers for our growing list of 60,000 subscribers, which includes DIY investors and investment pros.

If you have writing skills that go above and beyond technical analysis or if you have a marketing background or interest in marketing then it’s a major plus. The cornerstone of our investment approach is relative strength analysis, market and sector internals analysis and sector rotation.

You can be a ghostwriter, someone who writes chunks of what eventually becomes a full essay, or if you have great writing skills, could eventually become a writer for our team under your own name.

We are based in Boca Raton, Florida and have been in business since 2015 but the team running the firm has been very successful in the industry since 2005. If you live in the area

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Marianna Tessello

Marianna Tessello serves as the TAN Association's web

Members on the Move

The TAN Association would like to congratulate the following members on their new positions:

Robert Varghese, CMT, EVP, Portfolio Strategy & Management at Banyan Investment Group

Dan Shkolnik, CMT, Director, CPMS Sales (Equity Strategies) at Morningstar

Joshua I Wilson, CMT, Chief Executive Officer at Lake Point Advisory Group

Charles Kubiak, CMT, Software Crafter at 8th Light

Updating Your Profile

Have you recently joined the TAN Association and did not provide your address? Please login to the website and enter your address as we use this information to determine which and how many test centers are needed for a test administration or an upcoming one. This information is also used to produce reports on the exams.

To update your profile, login to the CMT website and under My CMT select My Account. On the following page, under My Account select Edit My Information.

Your cooperation is greatly appreciated!

CMT

The TAN Association would like to congratulate the following

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Marie Penza

Marie Penza serves as the Director of Member Services for the CMT

New Educational Content This Month

-

August 26, 2020

The CMT Experience

Presenter(s): Tyler Wood, Dave Lundgren, CMT, CFA

-

August 26, 2020

Reading the Current Market in Light of History’s Lessons

Presenter(s): Ryan Detrick, CMT

-

August 12, 2020

How to Spot Major Trend Reversals with Elliott Waves and Socionomics: Examples from Asia’s Ongoing Secular Bull Market

Presenter(s): Mark Galasiewski