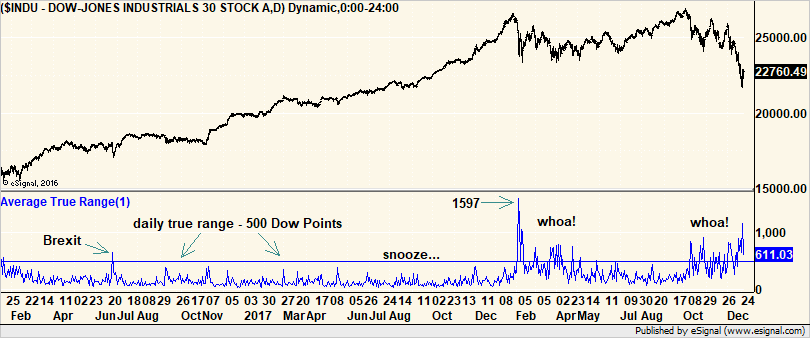

They say March comes in like a lion and goes out like a lamb. Well, 2018 came in like a lion and seems to have gone out like a lion, too. Check out this chart of the Dow’s daily true range going back to early 2016. Something is clearly different in 2018.

If there is one thing we can say about the markets, it’s that they're like a box of chocolates. Okay - Forrest Gump, CMT, might have said that.

As we reach our stride with the new newsletter format, we still need your feedback. What do you like? What would you like to see? Drop us a line at editor@CMTAssociation.org. And we could still use some volunteers to help with book, software and seminar reviews.

This month’s member interview is with two-time former past President Bruce Kamich. We’ve got the third, and final, installment of the reboot of Mark Eidem, CMT, CFA’s series on “Lessons from Dead Pilots,” again, which gives a fascinating comparison with traders.

And I did an interview with David Aferiat with

If there is one thing we can say about the markets, it’s that they're like a box of chocolates. Okay - Forrest Gump, CMT, might have said that.

As we reach our stride with the new newsletter format, we still need your feedback. What do you like? What would you like to see? Drop us a line at editor@CMTAssociation.org. And we could still use some volunteers to help with book, software and seminar reviews.

This month’s member interview is with two-time former past President Bruce Kamich. We’ve got the third, and final, installment of the reboot of Mark Eidem, CMT, CFA’s series on “Lessons from Dead Pilots,” again, which gives a fascinating comparison with traders.

And I did an interview with David Aferiat with

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

What's Inside...

President's Corner: Technicians - Fight the Right Fight

by Scott G. Richter, CMT, CFA, CHPAs CMTs, we should focus on our contributions to a successful investment process and not get bogged down in philosophical debates. Often times investors, and those that advise them, take sides and...

Judgment for Traders: Lessons from Dead Pilots – Part 3

by Mark Eidem, CMT, CFAOriginally published September 2000 In the past two months, I have introduced the thesis stating that the process of judgment is identical for pilots and traders. Furthermore, traders can learn...

Artificial Intelligence for Traders

by Michael Kahn, CMTArtificial Intelligence (AI) is not the spooky, self-aware robot technology you might think. Certainly, it is the driving force, pun fully intended, in autonomous vehicles, a.k.a. self-driving cars....

Interview with Bruce Kamich, our Featured Technical Analyst

by Bruce Kamich, CMTPlease tell us what you do professionally. I am a technical analyst for Jim Cramer – yeah, that Jim Cramer. Five days a week, I write seven to 10 articles or stories a day on the...

ETF Global – Portfolio Challenge and ETP Forum

by Tyler WoodThe TAN Association recently partnered with ETF Global, a New York-based data, research and investment analytics platform, on two exciting initiatives to support education and industry...

December in TAN Association history

by Michael Kahn, CMTFriday, December 17, 2004 – Association members David, Krell, Barry Sine, Ken Tower and Ralph Acampora went before the Securities and Exchange Commission (SEC) to defend technical analysis against...

News from Around the TAN Association

by Marie PenzaMembers on the Move The TAN Association would like to congratulate the following members on their new positions: Lovekush Kumar, Assistant Manager at Motilal Oswal Financial Services Ltd Tim Foli,...

As CMTs, we should focus on our contributions to a successful investment process and not get bogged down in philosophical debates.

Often times investors, and those that advise them, take sides and “fight” to see who is right. For technicians, this can be short-sighted thinking, because anyone can have success in the moment. Fighting the wrong fight takes a lot of energy and usually doesn’t result in much progress in terms of selling your ideas.

It’s not about technical vs. fundamental, or quant, or fusion. When you decide to fight, make sure you pick the right fight. This is especially true in the investment business when the number of technical jobs seems to be withering.

Start by taking a good look at how you and your CMT training can contribute to the investment process. Then consider how your involvement helps produce absolute or relative performance. Or, better yet, how does your involvement provide

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Scott G. Richter, CMT, CFA, CHP

Scott Richter, CMT, CFA, CHP is a senior portfolio manager for Westfield, which manages over $4B in AUM. He is the lead portfolio manager for alternative assets and is also responsible for investments in the energy and utility sectors. He was formerly the co-manager...

Originally published September 2000

In the past two months, I have introduced the thesis stating that the process of judgment is identical for pilots and traders. Furthermore, traders can learn from the errors in judgment that pilots have made which cost many their lives. Traders can adapt the work done by the Federal Aviation Administration (FAA) on the judgment process to become aware of potential errors in judgment processes and implement the changes needed to correct those errors.

In past articles, I introduced The Five Hazardous Attitudes that each of us possesses to some degree:

| Attitude | What Someone Possessing This Attitude Might Say |

|

Anti-Authority |

“Don’t tell ME what to do!” |

| Impulsiveness | “Oh no, this looks wrong. I’ve got to do something RIGHT NOW!” |

|

Invulnerability |

“That won’t happen to ME!” |

|

Macho |

To view this content you must be an active member of the TAN Association. Contributor(s)

Mark Eidem, CMT, CFAMark Eidem, who holds the Chartered Market Technician (CMT) designation, is a Regional Manager with Charles Schwab Trading Solutions. He is a 1978 graduate of West Point and was previously a retail broker in Anchorage for over a decade. He has served as a Flight Instructor... Artificial Intelligence (AI) is not the spooky, self-aware robot technology you might think. Certainly, it is the driving force, pun fully intended, in autonomous vehicles, a.k.a. self-driving cars. The software and sensors essentially replace humans in assessing the environment and making decisions concerning the operation of the vehicle. AI can make decisions much faster than humans, but its body of experience is still lagging. In other words, its creators cannot possibly program every possibility that might arise, and it will be up to the software to learn from its mistakes – or near misses – in order to cope. Of course, self-driving cars cannot make mistakes except perhaps for hitting a small pothole. Traders cannot make big mistakes either but have the luxury of trading small, or even just on paper, while they learn. Trading AI runs simulations for every possible condition, then back tests and optimizes the results. It can cover To view this content you must be an active member of the TAN Association. Contributor(s) Michael Kahn, CMTMichael Kahn, who holds a Chartered Market Technician (CMT) designation, is a seasoned financial services strategist, analyst, columnist, educator and speaker. Michael has been working with charts and technical analysis since 1986. He is the author of three books on... Please tell us what you do professionally. I am a technical analyst for Jim Cramer – yeah, that Jim Cramer. Five days a week, I write seven to 10 articles or stories a day on the technical condition of individual stocks. These could be companies that Jim has talked about on his CNBC show Mad Money. They could be in response to requests from readers of Real Money, or they could be reporting earnings soon or surging or plunging that day. Two nights a week, I teach technical analysis to 80 undergraduate students at Baruch College in New York City. I am not as busy as Cramer but I try to keep active. Just as the stock market every day is different, so is every semester. In this quant world it is a challenge to make traditional TA interesting and meaningful to 20-year-olds. How did you get there? I got this job To view this content you must be an active member of the TAN Association. Contributor(s)

Bruce Kamich, CMTBruce M. Kamich, who has held the Chartered Market Technician (CMT) designation since 1992, is a technical analyst for TheStreet.com and a two-time past president of the TAN Association. He serves as an advisor for the Technical Analysis Educational Foundation, of which he is... The TAN Association recently partnered with ETF Global, a New York-based data, research and investment analytics platform, on two exciting initiatives to support education and industry professionals. After a successful launch three years ago, the ETF Global Portfolio Challenge expanded to include thousands of students from six continents and 400 schools. The Portfolio Challenge is a web-based simulated investment competition designed to serve as an educational tool to help students understand market dynamics and learn about investing in Exchange-Traded Products. The TAN Association proudly supports the practical experience of a portfolio competition. How it works…Student investors construct a portfolio of four to 10 ETPs based on nominal assets under management (AUM) of one hundred thousand dollars ($100,000). Throughout the semester-long competition, players attempt to pick the top-performing ETPs. Each participant is evaluated on the investment performance of their respective virtual portfolio. Given the focus on ETP products, student competitors must understand technical concepts such as To view this content you must be an active member of the TAN Association. Contributor(s) Tyler WoodTyler Wood is the Managing Director of Global Business Development at the TAN Association. In collaboration with TAN Association members and charterholders, Tyler has presented the tools of technical analysis around the world to investment firms, regulators, exchanges, and... Friday, December 17, 2004 – Association members David, Krell, Barry Sine, Ken Tower and Ralph Acampora went before the Securities and Exchange Commission (SEC) to defend technical analysis against the Sarbanes-Oxley Law that was passed in January of that year. This historic event led to the SEC accepting technical analysis as a legitimate body of knowledge in March 2005. Now the technical TAN designation is on par with the fundamental CFA certification. To view this content you must be an active member of the TAN Association. Contributor(s) Michael Kahn, CMTMichael Kahn, who holds a Chartered Market Technician (CMT) designation, is a seasoned financial services strategist, analyst, columnist, educator and speaker. Michael has been working with charts and technical analysis since 1986. He is the author of three books on... Members on the MoveThe TAN Association would like to congratulate the following members on their new positions:

CMT NewsOver 1,130 candidates sat for the TAN exams during the December 2018 test administration. Prometric will email the results to the candidates in mid-January. The next test administration will take place May 31 to June 9, 2019.

Registration for the June 2019 test administration will open on January 3rd and closes on May 9th.

The TAN Association would like to congratulate the following To view this content you must be an active member of the TAN Association. Contributor(s) Marie PenzaMarie Penza serves as the Director of Member Services for the CMT New Educational Content This Month

|