Letter from the Editor

Letter from the Editor

Dr. Hank Pruden will receive the Mike Epstein Award later this month. The MTA Educational Foundation created this award to recognize those who make significant contributions to technical analysis in the academic community. Hank is without a doubt a worthy recipient.

The MTA Educational Foundation was founded in 1993 to create and fund educational programs in the field of technical analysis. The mission was later expanded to include the creation and support of a complete technical analysis curriculum to be taught for credit in colleges and universities around the world.

By the time the Foundation was established, Hank had almost twenty years experience in teaching technical analysis at the university level. He created not only a course, but was instrumental in developing a graduate-level certificate in technical analysis at Golden Gate University. Hank has long taught two courses in the Wyckoff Method, and has written a book that can be used at the Master’s degree level.

In addition to representing the field of technical analysis in academia, Hank has a long history of

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

What's Inside...

MTAEF to Honor Dr. Hank Pruden with the Mike Epstein Award

Well known for many years as a global expert in technical analysis, Dr Hank Pruden will be recognized for his academic accomplishments on November 10th by the MTA Educational Foundation. At the...

Member Profile: Henry Pruden, Ph.D

CAREER Hank Pruden is an internationally-known educator and speculator. He is a professor in the School of Business at Golden Gate University in San Francisco, California where he has been teaching...

Q&A with Kylie Jerg, CMT

by Kylie Jerg, CMTHow would you describe your job? I trade Managed Derivative accounts for private clients and provide technical analysis to clients on a subscription basis. I also proved the technical overview of the...

Spotlight Video: MTA Code of Ethics with Charles Comer

by Charles S. Comer, CMTCharles Comer led a discussion on ethics at the New York Region meeting in April 2008. This presentation is available in the On Demand Video Archives as well as the MTA Knowledge Base. To view it,...

Preferred Stocks: The Art of Profitable Income Investing by Kenneth G. Winans

by Ken Winans, CMT & Michael Carr, CMTAt first glance, this book may appear to be an updated second edition of Ken’s 2007 book, Preferreds: Wall Street’s Best Kept Income Secret. Although written only three years ago, that was...

Winans International Real Estate Index

In addition to completing groundbreaking work on preferred stocks, Ken Winans has also completed research on real estate prices. The WIREI is a valuable research tool, and standard technical analysis...

Supertrends: Winning Investment Strategies for the Coming Decades by Lars Tvede

by Lars Tvede & Michael Carr, CMTLars Tvede attempts to identify the most important changes to come in the future, and in this book his goal is to offer readers an understanding of “not only what will happen, but also how...

MTA Announcements

CMT Exam Fall Administration – Good Luck to All Participants! With the Chartered Market Technician (CMT) Exam period beginning today, the Market Technicians Association would like to wish a...

Well known for many years as a global expert in technical analysis, Dr Hank Pruden will be recognized for his academic accomplishments on November 10th by the MTA Educational Foundation. At the Second Annual MTAEF-MTA Library Fund-Raising Event, Hank will become the second recipient of the Mike Epstein Award.

The award is presented to practitioners who have demonstrated a long-term commitment to technical analysis in academia and in practice. The first recipient was Andrew Lo, Ph.D., director of laboratory for Financial

Engineering and professor of finance at MIT Sloan School of Management.

Hank has been active in technical analysis for many years, and began teaching at Golden Gate University more than 30 years ago in large part because the school would allow him to offer a course in technical analysis. At that time, Golden Gate became the first institution of higher learning in the world to offer courses in technical market analysis.

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

CAREER

Hank Pruden is an internationally-known educator and speculator. He is a professor in the School of Business at Golden Gate University in San Francisco, California where he has been teaching for more than 20 years. Hank is more than a theoretician; having actively traded his own account for more than 30 years he has placed real equity at risk based upon the theories he teaches. His personal involvement in the market ensures that what he teaches is practical for

the trader, and not only abstract academic theory.

At Golden Gate he developed the accredited courses in technical market analysis in 1976. Since then the curriculum has expanded to include advanced topics in technical analysis and trading. In his courses Hank emphasizes the psychology of trading as well as the use of technical analysis methods. He has published extensively in both areas.

Hank has mentored

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

How would you describe your job?

I trade Managed Derivative accounts for private clients and provide technical analysis to clients on a subscription basis. I also proved the technical overview of the market for our Office and retail client base.

What led you to look at the particular markets you specialize in as opposed to another tradable?

I trade predominantly Equity futures, CFD’S and a small amount of Forex and this was really due to limitations in South Africa on tradable products. Single Stock Futures have only been readily accessible in S.A. since 2001 & CFD’s in 2005/6, currency futures since 2007 (through YieldX, currency futures exchange). Only select Forex pairs are traded through YieldX. Limited commodities were available and this was mainly agricultural. In the past year precious metals and Oil have been introduced. Our market is still “new” in comparison to the U.S. and Europe, but we are growing fast.

Do you

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Kylie Jerg, CMT

Kylie Jerg, who holds a Chartered Market Technician (CMT) designation, is a Portfolio Manager at Adviceworx. Previously, she was a trader with Banyan Holdings. She started out in the industry by providing training in technical analysis to private individuals wanting to learn to...

Charles Comer led a discussion on ethics at the New York Region meeting in April 2008. This presentation is available in the On Demand Video Archives as well as the MTA Knowledge Base. To view it, please click here.

Ethics is an area that is often considered to be timeless. This is largely true, but ethics have evolved in the marketplace. Market manipulation and insider trading was widely accepted in the nineteenth century and first part of the twentieth century, but has been considered unethical, and illegal, bow for nearly one hundred years. Charles began with a timeless concept – honesty is the best policy. While that’s a simple definition, he also offered a more complex one and defined ethics as a system or set of moral principles that guide conduct in any specter of human behavior. The MTA Code of Ethics is a set guideline for the behavior of CMTs,

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Charles S. Comer, CMT

Charles S. Comer, CMT is the Principal for Investment Strategies at Family Office Advisors. Before co-founding Family Office Advisors, Charles S. Comer built a widely recognized career in the investment industry. Published in Barron’s and a frequent guest on television...

At first glance, this book may appear to be an updated second edition of Ken’s 2007 book, Preferreds: Wall Street’s Best Kept Income Secret. Although written only three years ago, that was actually a long time in the current investment environment. The first book is an overview on what was then an almost forgotten investment instrument. This book is a review of the basics, and a retelling of the dramatic events that have occurred in the past few years. In Preferred Stocks, Ken also provides practical advice on how to invest in an understudied asset class.

To study preferreds, Ken developed an index, the Winans International Preferred Stock Index. A benchmark is important to any investor, and this index allows for evaluating investment performance and offers a comparison for assessing the relative merit of potential investments. In mid-October, the index was up more than 22% and had a current yield of

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Ken Winans, CMT

Ken Winans, CMT President & Founder, Winans Investments For 28 years, Ken Winans, CMT, has conducted groundbreaking financial research within the discipline of technical analysis while serving as a portfolio manager, investment analyst, broker and investor. Ken is the...

Michael Carr, CMT

Mike Carr, who holds a Chartered Market Technician (CMT) designation, is a full-time trader and contributing editor for Banyan Hill Publishing, a leading investment newsletter service. He is an instructor at the New York Institute of Finance and a contributor to various...

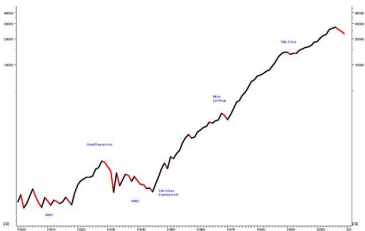

In addition to completing groundbreaking work on preferred stocks, Ken Winans has also completed research on real estate prices. The WIREI is a valuable research tool, and standard technical analysis techniques can be applied to the chart.

This long-term chart shows that home prices were actually rather volatile in the first few decades of the twentieth century. After World War 2, they began an almost uninterrupted climb higher, until topping in 2007. This chart offers a benchmark index to evaluate potential investments against.

A more detailed chart can be used to spot turning points in home prices. Moving averages can be applied to the price data, and market internals can be studied. In the case of real estate, housing starts serve as a measure of potential supply. Home sales indicate demand. We can see that

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Lars Tvede attempts to identify the most important changes to come in the future, and in this book his goal is to offer readers an understanding of “not only what will happen, but also how and why.” An obvious question is whether or not this is an investment book, and in fact knowing which sectors are likely to experience growth tells traders which stocks could see gains, and perhaps even bubbles. While it’s difficult to spot bubbles in real time, this book potentially offers clues since significant change in the economy is frequently associated with irrationally exuberant episodes in the stock market.

At his web site, http://www.supertrends.com/supersectors/, Lars offers some insights that could help traders create watch lists of potential investment themes.

Seven sectors will do particularly well between 2010 and 2050:

- Finance

- The real estate sector

- The resources industry

- Alternative energy

- Luxury

- Genomics and biotech

- IT

In the book, he offers a detailed analytical framework that can be used

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Lars Tvede

Lars Tvede spent 11 years as a derivatives trader, portfolio manager and investment banker before moving to the telecommunications and software industries in the mid 1990s. Since then he has cofounded and seed-funded a number of high-tech companies and Beluga, a profitable...

Michael Carr, CMT

Mike Carr, who holds a Chartered Market Technician (CMT) designation, is a full-time trader and contributing editor for Banyan Hill Publishing, a leading investment newsletter service. He is an instructor at the New York Institute of Finance and a contributor to various...

CMT Exam Fall Administration – Good Luck to All Participants!

With the Chartered Market Technician (CMT) Exam period beginning today, the Market Technicians Association would like to wish a special ‘good luck’ to all those who are sitting for TAN Levels 1, 2, and 3.

As we have discussed previously, candidates taking TAN Levels 1 and 2 will not receive immediate results at the test center but will receive a completion notification. You will receive your pass/fail results, in about six weeks, in an email from the MTA office. As in the past, TAN Level 3 candidates will not receive immediate results and can expect to get their results by the end of December. In addition, please refrain from discussing the contents of the exam or disclosing any information about the contents of this exam to anyone, whether in discussion forums, emails, face-to-face, etc. The MTA takes these

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

New Educational Content This Month

-

August 26, 2020

The CMT Experience

Presenter(s): Tyler Wood, Dave Lundgren, CMT, CFA

-

August 26, 2020

Reading the Current Market in Light of History’s Lessons

Presenter(s): Ryan Detrick, CMT

-

August 12, 2020

How to Spot Major Trend Reversals with Elliott Waves and Socionomics: Examples from Asia’s Ongoing Secular Bull Market

Presenter(s): Mark Galasiewski