Letter from the Editor

Letter from the Editor

In this issue of Technically Speaking, we provide a great deal of information on market breadth. An interview with well known technician Dick Arms provides insight into the work and current thinking of an industry legend.

Several articles detail a small part of the work of Dr. Humphrey Lloyd, unknown to the majority of technicians. Although trained as a pathologist, he has written widely on technical analysis and has developed unique and useful indicators. In learning about Dr. Lloyd’s work, I personally was struck by the similarity to the life of a technician who came to the field late in life but produced more than many others who spend their whole lives researching market action – Arthur A. Merrill, CMT.

Both enjoyed great success in their original profession. Both brought the skills they employed in that profession to the markets. Both men were prolific authors, sharing their knowledge with all who wished to learn. But the most defining characteristic of both is that they can best be described as “gentlemen.”

This is an

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

What's Inside...

A Nontraditional Technician

by Michael Carr, CMTIt seems that technical analysis is a great second career for many successful people. Arthur Merrill is a well known example of someone who spent a lifetime succeeding as an engineer and finding...

MBI in MetaStock

Developed by Matthew N. Xiarhos, CFP, Founder & Chief Investment Officer of Absolute Return Portfolio Management LLC, and reprinted with permission. Matthew may be reached at...

TradeStation Code for the Moving Balance Indicator

by Mike GutmannThis code is presented as a general guide for programming and may not be 100% correct. inputs: AdvIssues( Close of data1 ), DecIssues ( Close of data2 ), AdvVol ( Close of data3 ), DecVol ( Close of...

Stock Trading 101: Dr. Humphrey Lloyd's Timeless Trading Tips

The RSL Market Timing Method summarized two decades of Dr. Lloyd’s research into the markets when it was published in 1991. In addition to providing specific trading methods, the book contains...

Letter to the Editor

by Robert PeirceThe November issue of Technically Speaking included an article called “The Importance of Mid-Term Year Lows” by Paul Shread, CMT. Bob Pierce offered the following insight related to that cycle: I...

Buy & Hold Investing 'R.I.P.'

by Ken Winans, CMTEvery bull market produces its fair share of investment myths and financial fads. During the “Roaring” 1920’s, buying equities with high levels of margin debt was the norm among...

An Interview with…Dick Arms

by Dick Arms & Yevgen AvramychRichard Arms, a pioneer in the field of technical analysis, recently gave me the pleasure of speaking with him about his own past and the state of the markets today. Arms has been watching the...

Short Term Trading Strategies That Work by Larry Connors and Cesar Alvarez

by Laurence Connors & Cesar Alvarez & Michael Carr, CMTLarry Connors and the firm he founded, TradingMarkets.com, are known for exhaustive research. In Short Term Trading Strategies That Work,Connors and Alvarez exceed the high standards they are known...

The Source of Grumbling from Industry IT Departments

by Clare White, CMTIf you’ve heard an increased level of distress coming from your IT Department, there’s a good chance it stems from the Options Symbology Initiative (OSI). While the transition to penny...

Teaching Technical Analysis in an Academic Setting

by Matthew Caruso, CMTHaving served as director of the Montreal chapter of the Canadian Society of Technical Analysts (CSTA) for two years, as well as vice president for several months, discussing technical analysis with...

MTA Announcements

MTA Educational Web Series – Sign Up Now The MTA is pleased to announce the next presentations of the FREE MTA Web Series. Friday, March 6th, 12:00 PM EST, Ned Davis and Tim Hayes, CMT will...

It seems that technical analysis is a great second career for many successful people. Arthur Merrill is a well known example of someone who spent a lifetime succeeding as an engineer and finding possibly even greater success in his second career as a market technician. Dr. Humphrey Lloyd presents a similar story, with success in two professions and valuable contributions to the field of technical analysis.

Born and raised in the United Kingdom, Dr. Lloyd studied medicine there before he immigrated to the United States in 1958. He worked as a pathologist in Beverly MA from 1960 until he retired in 1997. For almost this entire time, he studied and traded the markets. In Dr. Lloyd’s own words:

I became attracted to the problems associated with investing in the stock market in the early 60s, as I identified that many similarities existed between the mental act of making a diagnosis

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Michael Carr, CMT

Mike Carr, who holds a Chartered Market Technician (CMT) designation, is a full-time trader and contributing editor for Banyan Hill Publishing, a leading investment newsletter service. He is an instructor at the New York Institute of Finance and a contributor to various...

Developed by Matthew N. Xiarhos, CFP, Founder & Chief Investment Officer of Absolute Return Portfolio Management LLC, and reprinted with permission. Matthew may be reached at MattX@ARPortfolios.com or 800-477-1296 x103. His web site is www.ARPortfolios.com.

Matthew did modify the formulation slightly, “Because of the ever-increasing volumes the original formulas needed to be changed. I tried to stay true to the idea and Humphrey never mentioned any fault with my approach so I assume he agreed. These revisions should allow the indicator to be used over a long period of time without the artifact of higher volumes interfering with interpretation or comparison with periods from long in the past.”

5 Day Computation of MBI:

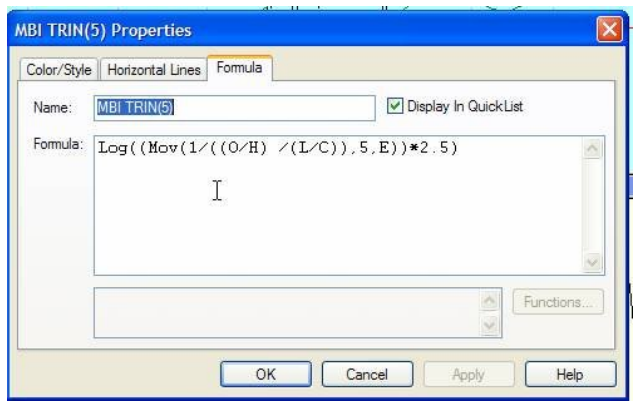

The following are screenshots of MetaStock’s formula builder…

TRIN Component:

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

This code is presented as a general guide for programming and may not be 100% correct.

inputs:

AdvIssues( Close of data1 ),

DecIssues ( Close of data2 ),

AdvVol ( Close of data3 ),

DecVol ( Close of data4 ),

MBILength ( 10 ),

MBIOB ( 70 ),

MBIOS ( 45 )

;

vars:

AD ( 0 ), AD1 ( 0 ), AD2 ( 0 ), AD3 ( 0 ),

ADV ( 0 ), ADV1 ( 0 ), ADV2 ( 0 ), ADV3 ( 0 ),

TRINX ( 0 ), TRINX1 ( 0 ), TRINX2 ( 0 ), TRINX3 ( 0 ),

MBI ( 0 )

;

vars:

spacent1 (0); spacent2 (0); spacent3 (0); spacent4 (0);

AD1 = Average ( AdvIssues, MBILength );

AD2 = Average ( DecIssues, MBILength );

AD3 = ( AD1 / AD2 ) * 10 ;

AD = Round ( AD3, 1 );

ADV1 = ( AdvVol / ( AdvVol +

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Mike Gutmann

Bio

The RSL Market Timing Method summarized two decades of Dr. Lloyd’s research into the markets when it was published in 1991. In addition to providing specific trading methods, the book contains general observations that he found to be helpful in his own trading, and that will benefit day traders, long-term investors, and anyone involved in the markets. This general philosophy was then presented in Stock Traders Almanac. These ideas should be read slowly, and although they appear to be short, they might require a great deal of time to think about.

- Winning takes determination, courage, thought, patience, honesty, and a sense of detachment from the results.

- You have to accept that you cannot win on every roll.

- Never trade against the trend in anticipation of a trend change.

- Try to find out as early as possible what works for you as an individual and stick with it.

- Be prepared to buy new highs and sell

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

The November issue of Technically Speaking included an article called “The Importance of Mid-Term Year Lows” by Paul Shread, CMT. Bob Pierce offered the following insight related to that cycle:

I find the 4-year pattern to be the strongest indicator of all the ones I use. I treat it as positive for 30 months and negative for 18, rather than a basic 24:24 interpretation. I don’t know if it would be as strong handled another way. At any rate, the key here is that like any continuing pattern, it is sometimes early or late. So far, it has never skipped a cycle but that also is possible.

What caught my eye a year or so ago was that we missed the scheduled low in 2006 and didn’t get one in 2007. I have seen it early or late by a year, which is why I mention this. I went back to check

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Robert Peirce

Robert Peirce is a principal and co-founder of Cookson, Peirce & Co.

Every bull market produces its fair share of investment myths and financial fads.

During the “Roaring” 1920’s, buying equities with high levels of margin debt was the norm among everyday investors. In the mega bull market from 1982 – 2000, it was the notion of buying and holding index funds at all times that became the cornerstone strategy for many institutional and small investors alike.

There is one problem: both strategies led investors off a financial cliff! Winans International completed a study that compared three different investment strategies using S&P 500 Index funds from December 1987 through 2008. Two different scenarios were analyzed. One where all capital was invested at once (i.e., beginning lump sum investment), and the other was building up a portfolio gradually by investing $500 per month through dollar cost averaging. As the table shows, the buy and hold strategy dramatically under performed portfolios where exposure to the stock

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Ken Winans, CMT

Ken Winans, CMT President & Founder, Winans Investments For 28 years, Ken Winans, CMT, has conducted groundbreaking financial research within the discipline of technical analysis while serving as a portfolio manager, investment analyst, broker and investor. Ken is the...

Richard Arms, a pioneer in the field of technical analysis, recently gave me the pleasure of speaking with him about his own past and the state of the markets today.

Arms has been watching the markets for quite some time now. He began his career about 50 years ago as a clerk in a brokerage firm. Over time, through knowledge, hard work, and an ability to communicate with investors, he became one of the most famous market technicians in the world.

In the early stages of his career Arms struggled to predict market activity with the tools at his disposal. In his experience, none of them seemed to work and the logic many of them didn’t make any sense to him. This led him to study technical analysis, as he identified a need to rationalize market activity and facilitate the understanding of what price movements were really implying.

After completing courses in the

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Dick Arms

Richard Arms was a financial consultant to institutional investors and a private portfolio manager based in Albuquerque, New Mexico, until his death in March 2018. Dick wrote five books on Technical Market Analysis, focusing always on volume of shares traded, not just...

Yevgen Avramych

Yevgen Avramych works in the investment services area of Prudential Financial in New Jersey. He is a graduate of Seton Hall University, with a degree in Finance and minor in Economics. Yevgen has passed the level 1 exam of the CMT

Larry Connors and the firm he founded, TradingMarkets.com, are known for exhaustive research. In Short Term Trading Strategies That Work,Connors and Alvarez exceed the high standards they are known for and document specific trading ideas with enough detail to allow individuals to implement them immediately.

However, TradingMarkets.com is dedicated to education and this book also adheres to that principle. The testing in the book shows the possible rewards, but appears to deliberately ignore the risk side of the trading equation. Since risk management is central to trading success, individuals will need to validate the extraordinary test results presented and in that way, they will actually have personal ownership of the strategies.

The book presents sixteen specific strategies. Detailed testing shows that it’s better to buy stocks in uptrends rather than those in downtrends and the rules for defining trends are completely disclosed. A chapter is dedicated to an indicator that the authors

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Laurence Connors

Laurence Connors is Chairman of The Connors Group (TCG), and the principal executive officer of Connors Research LLC. TCG is a financial markets information company that publishes daily commentary and insight concerning the financial markets and has twice...

Cesar Alvarez

For the last six years, Cesar Alvaraz has written for his popular quant blog, Alvarez Quant Trading helping traders learn about the markets. He spent nine years as the Director of Research for Connors Research and TradingMarkets.com. Numerous strategies he created have been...

Michael Carr, CMT

Mike Carr, who holds a Chartered Market Technician (CMT) designation, is a full-time trader and contributing editor for Banyan Hill Publishing, a leading investment newsletter service. He is an instructor at the New York Institute of Finance and a contributor to various...

If you’ve heard an increased level of distress coming from your IT Department, there’s a good chance it stems from the Options Symbology Initiative (OSI). While the transition to penny increments was a challenge, this initiative creates a new format for option symbols and a new structure for transmitting quotes and data for a variety of Options Clearing Corporation (OCC) products. These include equity and exchange-traded fund (ETF) options.

Sure equity data vendors have challenges, but a substantial number of listed equities and ETFs have options. And those options can include four to six months of expirations with a strike price list (puts & calls) that grows as volatility swings create demand at varying prices. Add the existence of dollar strikes for ETFs and the storage impact for an additional field or two for reporting becomes pretty significant.

Since many of the parties involved with the OSI process have been down this

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Clare White, CMT

Clare White, who holds a Chartered Market Technician (CMT) designation, is the President of InVelocity, LLC where she provides educational content for technical and options analysis for the US equities and options markets for her client, Optionetics, Inc. She also provides...

Having served as director of the Montreal chapter of the Canadian Society of Technical Analysts (CSTA) for two years, as well as vice president for several months, discussing technical analysis with others is nothing new to me. However, when Dr. Sandra Betton, Associate Professor and Chair of the Finance Faculty at Concordia University’s John Molson School of Business, contacted me in June of last year about the possibility of having a CSTA member teach a class entitled, “Building a Profitable Trading System,” I knew I would be embarking on something very new. The possibility of having TA taught in an undergraduate course in the finance program was an opportunity that I couldn’t let my profession miss out on. Given that putting a new course together would be a substantial amount of work, I enlisted the aid of a good friend and former CSTA director, Riccardo Romeo, CFA, and TAN Level

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Matthew Caruso, CMT

Matthew Caruso, CMT is a senior pro equity trader for National Bank financial as well as president of the Canadian Society of Technical analysts. He is past adjunct professor and co-creator of Canada’s first fully accredited technical analysis course at Concordia University...

MTA Educational Web Series – Sign Up Now

The MTA is pleased to announce the next presentations of the FREE MTA Web Series.

- Friday, March 6th, 12:00 PM EST, Ned Davis and Tim Hayes, CMT will present “Tape Indicators And Global Market Volatility.” Click here to register for this webcast.

- Wednesday, March 11th, 4:30 PM EST, Stephen Bigalow will present “The 12 Major Candlestick Signals, Providing Valuable Insights Into Price Trends.” Click here to register for this webcast.

- Tuesday, March 24th, 4:30 PM EST, Ralph Vince will present “Maximize the Probability of Being Profitable at Some Prescribed Future Point in Time.”Click here to register for this webcast.

View the Educational Web Series table below for a complete listing of webcasts that have already been scheduled into June!

CMT Exam Registration – Sign Up Now!

Desired dates,

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

New Educational Content This Month

-

August 26, 2020

The CMT Experience

Presenter(s): Tyler Wood, Dave Lundgren, CMT, CFA

-

August 26, 2020

Reading the Current Market in Light of History’s Lessons

Presenter(s): Ryan Detrick, CMT

-

August 12, 2020

How to Spot Major Trend Reversals with Elliott Waves and Socionomics: Examples from Asia’s Ongoing Secular Bull Market

Presenter(s): Mark Galasiewski