Letter from the Editor

Letter from the Editor

This issue contains a few more summaries of MTA Symposium speaker presentations. There were two other presentations that no one should miss, but are in some ways too important to offer in summary form.

The Technician’s Technician Panel brought together the technical analysts employed by the largest firms. Jordan Kotick, CMT, Managing Director and Head of Technical Trading Strategy for Barclays Capital, led the discussion and shared the stage with:

- Richard Adcock, MSTA, Executive Director, Fixed Income Technical Strategy (London), UBS

- Mary Ann Bartels, Head of US Technicals and Market Analysis, Bank of America Merrill Lynch

- Muray Gunn, CFTe, Head of Technical Analysis, HSBC

- Michael Krauss, Managing Director and Head of Global Fixed Income Technical Analysis, J.P. Morgan Securities

- Tom Pelc, MSTA, CFTe, Head of Technical Strategy, RBS Group

- David Sneddon, Managing Director, Credit Suisse

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

What's Inside...

MTA Annual Award for 2011 Recognizes Richard Donchian

The Annual Award is issued to a person who made an outstanding contribution to the field of technical analysis. This year, Richard Donchian, a pioneer in the filed was recognized by the MTA. He is...

MTA Annual Symposium: Applying Timing to Global Markets by Tom DeMark

by Tom DeMark & Michael Carr, CMTTom DeMark is a well-known and widely followed market timer. During his career, the Dow Jones Industrial Average has traded below 600 and higher than 14,000 so he is a veteran of bull and bear...

Cloud Charts – Identifying Trend Changes in Global Markets Presented at the MTA Annual Symposium by David Linton, MFTA

by Michael Carr, CMTNew techniques are always part of the MTA Symposium. Although Cloud Charts have been around for some time, they are still a relatively unknown technique, and the first exposure to the charts for many...

Interest Rises Sharply In Penn State Trading Contest

by Bruce Kamich, CMTBruce Kamich, CMT, President of the MTA Educational Foundation (MTAEF), provides this brief summary of a recent trading contest for college students that was co-sponsored by the MTAEF. Penn...

Letter from the New Editor of the Journal of Technical Analysis

by Julie Dahlquist, Ph.D., CMTEditor’s Note: Julie Dahlquist, Ph.D, CMT, was recently named as the Editor of the MTA’s premier research publication. She provided the following comments: I am excited to serve as the new Editor...

Interview with Ken Winans, CMT

by Ken Winans, CMT & Amber Hestla-BarnhartHow would you describe your job? I am President and Founder of Winans International Investment Management & Research. My job involves overseeing the functions of running an investment firm...

Relative Strength on Long-Term Charts

by Michael Carr, CMTOne of the most widely used tools in technical analysis is relative strength. The idea behind this technique is to identify individual stocks which are outperforming the general market. Numerous...

MTA Announcements

MTA Membership Dues Renewal Approximately 25% of our membership has dues expiring in the months of June and July. It is important that you renew in a timely fashion to ensure there is no disruption...

The Annual Award is issued to a person who made an outstanding contribution to the field of technical analysis. This year, Richard Donchian, a pioneer in the filed was recognized by the MTA. He is probably best known among market technicians for developing the fourweek rule. This trading strategy buys when prices reach a new four-week high and sells when prices reach a new four-week low. The system is always in the market, long or short.

The Annual Award is issued to a person who made an outstanding contribution to the field of technical analysis. This year, Richard Donchian, a pioneer in the filed was recognized by the MTA. He is probably best known among market technicians for developing the fourweek rule. This trading strategy buys when prices reach a new four-week high and sells when prices reach a new four-week low. The system is always in the market, long or short.

Donchian had a very successful career, which is summarized in his biography at the web site of a charitable foundation he founded (http://www.foundationservices.cc/RDD2/aboutus.htm).

Richard Davoud Donchian was born in Hartford, Connecticut, in September, 1905, the son of Samuel B. Donchian and Armenouhi A. Davoud, both of whom migrated from the Armenian province of Turkey in the

1880’s. Richard attended public schools in Hartford, the Taft School in Watertown,

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Tom DeMark is a well-known and widely followed market timer. During his career, the Dow Jones Industrial Average has traded below 600 and higher than 14,000 so he is a veteran of bull and bear markets and has endured years of sideways action as well. In his talk, he offered a few reflections based upon what he has seen in the markets over the past 40 years.

As he began working in the industry, Tom was following a typical career path. He began as an analyst at NN Investment services, a subsidiary of Northwestern National Insurance in January 1972. He began studying for the Chartered Financial Analyst (CFA) exam, and he commented that he had completed the C and F before realizing he wasn’t getting as much out of the program as he had hoped. Technical analysis was interesting and seemed as a practical approach to making money, and his firm

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Tom DeMark

Tom DeMark is the creator of the DeMARK Indicators® and the founder and CEO of DeMARK Analytics, LLC. The DeMARK studies are known internationally for their objective and mechanically-driven approach to both trading and investing, and are designed to anticipate potential...

Michael Carr, CMT

Mike Carr, who holds a Chartered Market Technician (CMT) designation, is a full-time trader and contributing editor for Banyan Hill Publishing, a leading investment newsletter service. He is an instructor at the New York Institute of Finance and a contributor to various...

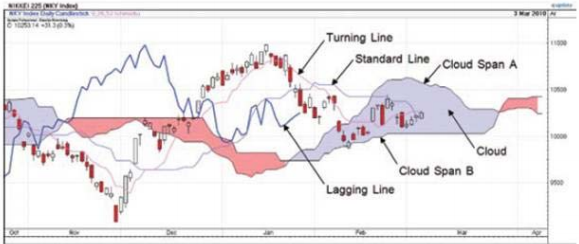

New techniques are always part of the MTA Symposium. Although Cloud Charts have been around for some time, they are still a relatively unknown technique, and the first exposure to the charts for many of the attendees was during David’s presentation. Ichimoku Clouds are based on principles first identified by traders in Japan in the 1930s.

To technicians, a picture is almost always worth a thousand words, and David understood his audience. He began with an example of a Cloud Chart and an explanation of what the chart showed.

SOURCE: WWW.CLOUDCHARTS.COM

SOURCE: WWW.CLOUDCHARTS.COM

Clouds are overlaid on price charts. The key components of the Could Chart are:

- Turning Line – midpoint of the high and low of the last 9 sessions.

- Standard Line – midpoint of the high and low of the last 26 sessions.

- Cloud Span

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Michael Carr, CMT

Mike Carr, who holds a Chartered Market Technician (CMT) designation, is a full-time trader and contributing editor for Banyan Hill Publishing, a leading investment newsletter service. He is an instructor at the New York Institute of Finance and a contributor to various...

Bruce Kamich, CMT, President of the MTA Educational Foundation (MTAEF), provides this brief summary of a recent trading contest for college students that was co-sponsored by the MTAEF.

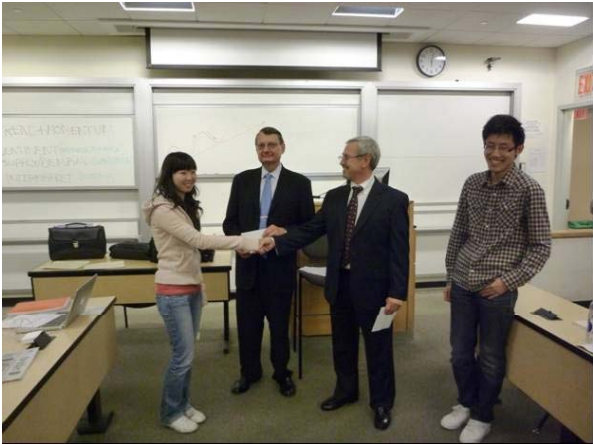

Penn State’s 2011 Smeal College of Business Trading Strategy Competition was sponsored by TradeStation Securities and the MTAEF. Participation rose sharply from last year when just 7 schools entered. This year 22 universities and over 160 students took part in the contest that began March 7.

Students traded three popular ETFs using TradeStation programs. The competitor with the best average rank was deemed the winner. Baruch students dominated the top 20 positions and this year took home the prize money for first and third place finishes.

Baruch College students Linying Wu (left) and Kun Mao (right) received their checks in class from Phil Roth,

Baruch College students Linying Wu (left) and Kun Mao (right) received their checks in class from Phil Roth,

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Bruce Kamich, CMT

Bruce M. Kamich, who has held the Chartered Market Technician (CMT) designation since 1992, is a technical analyst for TheStreet.com and a two-time past president of the TAN Association. He serves as an advisor for the Technical Analysis Educational Foundation, of which he is...

Editor’s Note: Julie Dahlquist, Ph.D, CMT, was recently named as the Editor of the MTA’s premier research publication. She provided the following comments:

I am excited to serve as the new Editor of the Journal of Technical Analysis. Since it was first published as the MTA Journal in 1978, the Journal has been the premier outlet for research relevant to the theory, practice, and application of

technical analysis. Many talented individuals have contributed to the success of the Journal, including the former editors, committee members, paper reviewers, and paper authors. Building on the work of these dedicated people, I am

eager to use my writing, publishing, and research experience to enhance the value of the Journal to the members of the MTA.

As the new Editor I am personally committed to the production of a journal that provides valuable information to the MTA membership through articles that are of interest and use

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Julie Dahlquist, Ph.D., CMT

Julie Dahlquist, Ph.D., CMT is Associate Professor of Professional Practice in the Finance Department at Texas Christian University (TCU). Previously, she served on the faculty in the business schools at University of Texas at San Antonio and at St. Mary’s University. Her...

How would you describe your job?

I am President and Founder of Winans International Investment Management & Research. My job involves overseeing the functions of running an investment firm (marketing the firm’s services, investment management, investment research, client servicing, and business operations). Yes, I still find time to do my own research. Go to www.winansintl.com for more details.

What led you to look at the particular markets you specialize in instead of another tradable?

After the 1987 Crash, I realized that brokers and investment advisors who had books of business (i.e., clients) in core assets (stocks, bonds, REITs, etc.) were not the people losing their jobs on Wall Street. My plan was to focus my research and asset raising efforts in mid to large cap stocks and high to mid-grade corporate bonds. This plan worked well in that I succeeded in making Merrill Lynch’s “Executive Club” for new client development during my rookie

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Ken Winans, CMT

Ken Winans, CMT President & Founder, Winans Investments For 28 years, Ken Winans, CMT, has conducted groundbreaking financial research within the discipline of technical analysis while serving as a portfolio manager, investment analyst, broker and investor. Ken is the...

Amber Hestla-Barnhart

One of the most widely used tools in technical analysis is relative strength. The idea behind this technique is to identify individual stocks which are outperforming the general market. Numerous academic studies have shown that a portfolio comprised of stocks which have been market leaders for the past 3-12 months will usually outperform the market averages over the next 3-12 months. There are a number of ways to calculate relative strength, and practitioners apply the idea in a number of different ways.

Broad index analysis is another tool that technicians use to identify long-term trends in the stock market. To do this, a ratio of two indexes is charted, in effect creating a relative strength chart between the two indexes.

Louise Yamada, CMT, presents a detailed explanation of this idea in her 1998 book, “Market Magic.” She shows how the Capital/Consumer ratio could be used to help identify major stock market turning

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Michael Carr, CMT

Mike Carr, who holds a Chartered Market Technician (CMT) designation, is a full-time trader and contributing editor for Banyan Hill Publishing, a leading investment newsletter service. He is an instructor at the New York Institute of Finance and a contributor to various...

MTA Membership Dues Renewal

Approximately 25% of our membership has dues expiring in the months of June and July. It is important that you renew in a timely fashion to ensure there is no disruption in overall MTA services. To renew, simply log into MyMTA and in the middle of that page you will find a section under “Membership Information” called “My Membership.” There you will find a link to renew your member dues. If you would prefer, you can call the MTA Headquarters at 646-652-3300 and renew over the telephone with any of the MTA Staff members.

Fall CMT Exam Administration – Registration Now Open!

Registration for the Fall 2011 Administration of the CMT Exam is now open for all levels! Sign up today to ensure your preferred location by visiting: http://go.mta.org/registercmt. If you need help registering or have any trouble scheduling your exam with Prometric (our outside

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

New Educational Content This Month

-

August 26, 2020

The CMT Experience

Presenter(s): Tyler Wood, Dave Lundgren, CMT, CFA

-

August 26, 2020

Reading the Current Market in Light of History’s Lessons

Presenter(s): Ryan Detrick, CMT

-

August 12, 2020

How to Spot Major Trend Reversals with Elliott Waves and Socionomics: Examples from Asia’s Ongoing Secular Bull Market

Presenter(s): Mark Galasiewski