LETTER FROM THE EDITOR

This month and next, we will feature information covered at the MTA Annual Symposium. This year’s event was the best to date. The quality of the speakers, attendees and collaborative partners was exceptional. Planning is now underway for the 2015 Symposium. If you would like to provide feedback to the MTA on your experience, or make suggestions for topics and speakers next year, please fill out this brief survey: https://www.surveymonkey.com/s/HY39WYV

The Symposium committee pulled together a wide array of thought leaders from the investment industry. Technically Speaking will feature summaries of some of the innovative and thought provoking presentations next month. No planning committee can control the quality of attendees. The fact that so many intelligent and personable analysts decide to attend every year is a reflection of the MTA membership. The organization attracts the best and the brightest minds in our field. Great attendees add to the educational value of the Symposium and provide networking opportunities that each member finds in their own way.

Collaborative Partners provide support to the event

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

What's Inside...

2014 CHARLES H. DOW AWARD WINNER - AN INTERMARKET APPROACH TO BETA ROTATION: THE STRATEGY, SIGNAL, AND POWER OF UTILITIES

by Charlie Bilello, CMT & Michael Gayed, CFASince 1994, the MTA has presented the Charles H. Dow Award for excellence and creativity in technical analysis. The papers honored with the Award have represented the richness and depth of technical...

RRG WEIGHTS

by Mathew Verdouw, CMT, CFTeSince I was introduced to Relative Rotation Graphs, I have been constantly playing with them and trying to see how they can give me insights into what is happening in the market. I love looking at...

MEMORIAL AWARD FOR JOSEPH E. GRANVILLE

by Dr. Jerry Blythe, MDEditor’s note: this is a reprint of the comments Dr. Jerry Blythe delivered at the MTA Annual Gala dinner when presenting the Memorial Award to Karen Granville, Joe’s widow. I want to thank the...

CREATING EXCEPTIONAL CHARTS FOR YOUR PUBLICATIONS: 9 KEY INGREDIENTS

by stockcharts.comKey Ingredient 1: Global Availability You never know when an idea will hit or where you’ll be when you need access to your charts. The office is the logical place, but market technicians are...

INTERVIEW WITH MATT WELLER

by Matt Weller & Amber Hestla-BarnhartHow would you describe your job? Though my official title is Senior Technical Analyst, I would actually describe my job as one-third analyst, one-third educator, and one-third reporter. The most...

Since 1994, the MTA has presented the Charles H. Dow Award for excellence and creativity in technical analysis. The papers honored with the Award have represented the richness and depth of technical analysis.

In this year’s award-winning paper, the authors demonstrate a relatively simple market timing strategy that produced absolute performance and risk-adjusted returns that significantly outperform a buy and hold strategy of the market throughout multiple market cycles. This strategy is based on the principles of intermarket analysis and maintains constant exposure to the stock market. The authors show that their technique has worked in various market regimes and would have been profitable in periods of rising or falling interest rates, bullish and bearish stock markets and economic expansion and recession.

Specifically, Bilello and Gayed present a simple trading strategy called the Beta Rotation Strategy:

When a price ratio (or the relative strength) of the Utilities sector to the broad

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Charlie Bilello, CMT

Charlie Bilello, who holds the Chartered Market Technician (CMT) designation, is the Director of Research at Pension Partners, LLC, where he is responsible for strategy development, investment research and communicating the firm’s investment themes and portfolio positioning to...

Michael Gayed, CFA

Michael A. Gayed is Portfolio Manager at Toroso Investments, an investment management company specializing in ETF focused research, investment strategies and services designed for financial advisors, RIAs, family offices and investment managers. Prior to Toroso Investments,...

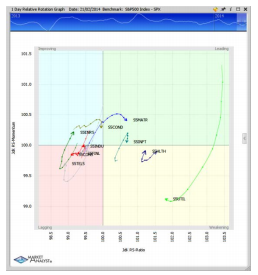

Since I was introduced to Relative Rotation Graphs, I have been constantly playing with them and trying to see how they can give me insights into what is happening in the market. I love looking at different Asset Classes, Currencies and Portfolios. My favorite group however will always be the SP500 GICS Level 1 sectors with the SP500 as the benchmark, because I know that the total of the ten sectors must be fully encompassed by the benchmark. The ten sectors embody all the elements that can contribute to the SP500 itself. When I look at the RRG, which measures trends in relative performance of each Sector against the Index, there has to be balance in each of the axis.

Figure 1 SP500 GICS Level 1 Sectors verses SP500 – Data from Bloomberg

Figure 1 SP500 GICS Level 1 Sectors verses SP500 – Data from Bloomberg

Consider Figure 1; we can see the ten sectors

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Mathew Verdouw, CMT, CFTe

Mathew Verdouw, who holds a Chartered Market Technician (CMT) designation, is the CEO and Founder of Optuma, and has been living and breathing Technical Analysis for over 22 years. As a Computer Systems Engineer he wrote his own TA platform, which has been used all over the...

Editor’s note: this is a reprint of the comments Dr. Jerry Blythe delivered at the MTA Annual Gala dinner when presenting the Memorial Award to Karen Granville, Joe’s widow.

I want to thank the MTA for the opportunity to honor a great man, Joe Granville, a pioneer who devoted his life to technical analysis, with a career spanning nearly 70 years and touching at one time or another most of us in this room.

He is receiving this year’s Memorial Award for a lifetime of service to the field. His wife Karen is here today to receive the award on his behalf.

What can we learn from this man’s life? Many of us knew Joe as brilliant, flamboyant and always a showman and entertainer, but there are many things about this man’s life you may not know.

I would begin with his hard work and generosity. Joe was a tireless worker, spending countless hours

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Dr. Jerry Blythe, MD

Joe Granville was a market analyst who published The Granville Market Letter from 1963 until his death in 2013. Joe popularized on balance volume and other technical indicators. In Nobel Prize winning economist Robert Shiller’s book, Irrational Exuberance, Shiller notes...

Key Ingredient 1: Global Availability

You never know when an idea will hit or where you’ll be when you need access to your charts. The office is the logical place, but market technicians are also thinking about the markets at home, when visiting clients, at restaurants or when traveling. Getting an idea into your analysis toolbox requires global accessibility on multiple devices.

StockCharts members can fetch custom SharpCharts and ChartLists anywhere with an internet connection. Revise a chart at home and the revision will be there when you access your account at the office. Change a client’s ChartList during a meeting and the changes will show up when you log into your account at the airport. Hear a news report about an intriguing company at home? You can immediately pull up the chart on your laptop and add it to a ChartList. In short, you can access your SharpCharts

wherever and whenever

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

stockcharts.com

How would you describe your job?

Though my official title is Senior Technical Analyst, I would actually describe my job as one-third analyst, one-third educator, and one-third reporter. The most obvious aspect of my job is to analyze the market and present actionable short-term trade ideas to our clients. I also spend a significant amount of my time educating traders on different strategies through daily articles and webinars so that they can identify trading opportunities independently. The third portion of my job entails reporting on major news

releases and market developments both on social media and within our platform, enabling our traders to make decisions based on the most up-todate information.

What led you to look at the particular markets you specialize in?

Of course, working at FOREX.com, I focus primarily on the foreign exchange market. The primary factor that initially drew me to currency market is the vast liquidity it offers, with

To view this content you must be an active member of the TAN Association.

Not a member? Join the TAN Association and unlock access to hundreds of hours of written and video technical analysis content, including the Journal of Technical Analysis and the Video Archives. Learn more about Membership here.

Contributor(s)

Matt Weller

Matt Weller is a Senior Technical Analyst on FOREX.com’s research team and has actively traded various financial instruments including stocks, options, and forex since 2005. Each day, Matt creates research reports focusing on technical analysis of the forex, equity, and...

Amber Hestla-Barnhart

New Educational Content This Month

-

August 26, 2020

The CMT Experience

Presenter(s): Tyler Wood, Dave Lundgren, CMT, CFA

-

August 26, 2020

Reading the Current Market in Light of History’s Lessons

Presenter(s): Ryan Detrick, CMT

-

August 12, 2020

How to Spot Major Trend Reversals with Elliott Waves and Socionomics: Examples from Asia’s Ongoing Secular Bull Market

Presenter(s): Mark Galasiewski