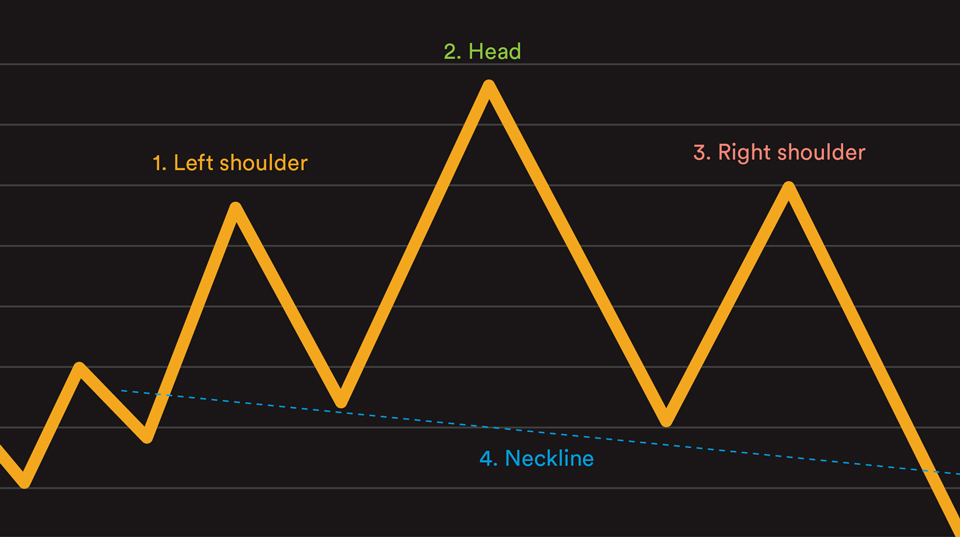

Lee Bohl, CMT, was featured in the Fall 2019 issue of On Investing, the quarterly community publication for Charles Schwab clients, with an article he authored on a classic technical analysis topic: how to identify head-and-shoulders patterns, like the kind in the illustration above.

"In my experience, those new to technical analysis tend to see head-and-shoulders patterns everywhere. That’s why taking the time to confirm signals, such as volume and the time frame of the preceding trends, is usually worth it. After a while, it will get easier to separate the heads and shoulders from the head fakes," said Bohl, instructing readers to look for several basic pattern components before declaring a definite head-and-shoulders formation and setting stops.

"[Use] some of the same risk-management tools that are part of your regular trading plan," he urged in the article.

Read the full article on Charles Schwab's On Investing website: Identifying Head-And-Shoulders Patterns in Stock Charts.

"In my experience, those new to technical analysis tend to see head-and-shoulders patterns everywhere. That’s why taking the time to confirm signals, such as volume and the time frame of the preceding trends, is usually worth it. After a while, it will get easier to separate the heads and shoulders from the head fakes," said Bohl, instructing readers to look for several basic pattern components before declaring a definite head-and-shoulders formation and setting stops.

"[Use] some of the same risk-management tools that are part of your regular trading plan," he urged in the article.

Read the full article on Charles Schwab's On Investing website: Identifying Head-And-Shoulders Patterns in Stock Charts.